After four consecutive 0.75 percent rate hikes, the Fed should slow down its rate increases, say at least three Federal Reserve Governors. That is good news as we try to assess the likelihood of another recession.

It’s good news because there are already signs of a possible soft landing in 2003, if the Fed will take their foot off the economic brakes until there is more certainty of its tightening efforts down the road.

Reuters quotes the Chicago Fed’s Charles Evens (San Francisco and Richmond Fed Presidents also advocate slowing) that it is time for the Federal Reserve to shift to smaller interest rate hikes to avoid tightening monetary policy more than needed and slow the pace further once risks become more "two-sided," (i.e., a possible recession) Chicago Fed President Charles Evans said on Friday.

"From here on out, I don't think it's front-loading anymore, I think it's looking for the right level of restrictiveness," Evans told Reuters in an interview, referring to the U.S. central bank's string of supersized rate hikes.

If the Fed did nothing more this year, we could have a ‘soft landing’ since growth is already slowing in both the manufacturing and service sectors of our economy.

New orders for factory goods are down, for instance (see top line in above FRED graph from 2/92) and holding at a lower level of activity. Orders for manufactured goods rose 0.3 percent in September, the Commerce Department said last Thursday, and orders have risen eleven months of the past year. The factory sector led the economy’s recovery from the pandemic because of huge pent-up demand for things like automobiles and other durable goods after the pandemic.

The ISM’s manufacturing index is now close to breakeven. The S&P global U.S. manufacturing PMI inched up to 50.4 in its “final” reading in October from the “flash” reading of 49.9. This is down from a reading of 52 in September.

“The U.S. manufacturing sector continues to expand,” said ISM Chair Timothy Fiore, “but at the lowest rate since the coronavirus pandemic recovery began. With panelists reporting softening new order rates over the previous five months, the October index reading reflects companies’ preparing for potential future lower demand.”

The Institute for Supply Management (ISM) serviced sector (non-manufacturing) Index that measures conditions at companies such as retailers and restaurants fell to 54.4 percent in October and touched the lowest level since the U.S. lockdowns in 2020, pointing to a slowing U.S. economy. A number above 50 signals expansion; but settling in a more normal range typical of a slower growing economy.

Granted this is before the Fed’s latest rate hikes take hold that could reduce the demand for goods and services even further, Consumer borrowing that is reported by the Fed is a better indicator of consumer wherewithal, since they wouldn’t be shopping as much as they have been if they fear an imminent recession.

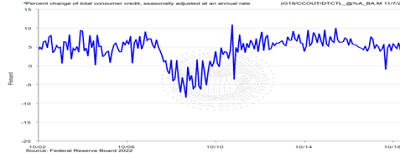

Consumer credit has been declining slowly, but again it is back to more normal pre-pandemic levels (see above Fed chart from 1/04). Revolving credit, like credit cards, rose 8.7 percent in September, less than half of the 18.1 percent gain in the prior month. Nonrevolving credit, typically auto and student loans, rose 5.7 percent, up from a 4.5 percent growth rate in the prior month. This category of credit is much less volatile.

The growing danger is to continue to tighten while there are still shortages of food and energy supplies, while demand is already shrinking in the rest of the world.

China’s economic woes are one example. Reuters reports “China's exports and imports unexpectedly contracted in October, the first simultaneous slump since May 2020, as a perfect storm of COVID curbs at home and global recession risks dented demand and further darkened the outlook for a struggling economy.”

The San Francisco Fed has also flagged the danger with its own published research that suggests we have already tightened too much. U.S. monetary policy is tighter than the Federal Reserve's policy rate suggests, according to research published Monday by the San Francisco Fed, with financial conditions by September 2022 reflecting the equivalent of a 5.25 percent policy rate, which it the top boundary of Chairman Powell’s own prediction.

"Accounting for the broader stance of policy and comparing the proxy rate to simple rules suggests U.S. monetary policy tightened sooner and more sharply than has been generally recognized," the Letter said.

Given what could be a brutal economic winter for much of the world, and demand maybe reaching parity with supply so that risks become more "two-sided" in Chicago Fed President Charles Evans words, we may now see a more benevolent Federal Reserve and enjoy the possibility of a soft landing.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment