After a sputtering start, it looks like the U.S. economy is picking up steam. First Quarter GDP growth was revised upward from 1.1 to 1.3 percent in the BEA’s second estimate yesterday.

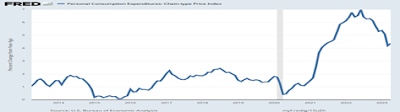

And the Personal Consumption Expenditure Index (PCE) out today (Friday), the Fed’s favorite inflation indicator, confirmed consumer spending is the main engine of growth. The PCE is the best measure of consumer behavior, and rather than pulling back because of higher inflation and interest rates, spending has kept up with inflation.

Compound this with predictions of up to 2.9 percent GDP growth in Q2, and we could be off to a ‘roaring’ 2023 year and decade I’ve been touting lately.

The result won’t make our Federal Reserve Governors happy who have been hinting at the possibility of a rate pause in June, since the PCE inflation index ticked up from 4.2 to 4.4 percent YoY.

PCE data showed consumer spending sprang back to life in April, rising 0.8%, the largest gain in three months, “surpassing expectations for a 0.5% increase as Americans bought more cars and spent more on services,” said a MarketWatch commentator. Why not, when consumers are fully employed and feeling more secure about their prospects?

Within services, the largest contributors to the PCE increase were spending for financial services and insurance, health care, and “other” services (notably professional and other services). Within goods, spending for motor vehicles and parts (led by new motor vehicles) and “other” nondurable goods (notably pharmaceutical products) were the largest contributors to the increase.

And lastly, orders for U.S. manufactured goods jumped 1.1 percent in April largely because of the military, but business investment also rose sharply in another positive sign for the economy. Manufacturing output has been shrinking over the last six months.

In a good sign, business investment rose a sharp 1.4 percent. What are corporations seeing that induces them to invest more? They are also expecting economic growth to improve.

The latest results show that consumers are in a tug-of-war with the Fed, which has been outspoken in its efforts to slow consumer spending with boosts to credit card and installment loan interest rates.

Yet Americans remained worried about the future of the economy, especially against the backdrop of another fight in Washington over the debt ceiling.

The University of Michigan sentiment survey final reading in May rebounded slightly to 59.2 from earlier in the month but was still lower than April’s 63.5 final reading.

“Consumer sentiment slid 7% amid worries about the path of the economy, erasing nearly half of the gains achieved after the all-time historic low from last June. This decline mirrors the 2011 debt ceiling crisis, during which sentiment also plunged,” said survey Director Joanne Hsu.

But they can’t be too worried as the post-pandemic surge in prosperity has been cancelling out the bad news.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment