Fed Chairman Ben Bernanke just gave his semi-annual report to Congress, and it looks like Bernanke and his Federal Reserve Governors continue to be cautious in advocating more stimulus. He said that the Fed had more ways to add stimulus but at present no plans to implement them. That is too bad, when a consensus is building that more monetary stimulus is needed to put monies into consumers’ pockets with jobs still hard to find.

Why have the Fed governors been so timid? It has more to do with ideology, than economic fundamentals. Since many of the Fed Governors are former bankers, they dislike debt, and the Fed has had to buy more than $2 trillion in mortgage-backed and Treasury securities to add liquidity to the system. This has kept interest rates at historic lows, but has only begun to bring real estate and job creation out of their doldrums.

Job formation has really been increasing since January, and real estate prices have inched up, but sales remain stagnant. This is while corporations have reported record profits over the last 2 quarters with the highest profit margins since WWII, yet have not been investing in either new plants or employees. Bernanke in his latest Humphrey-Hawkins congressional testimony said that it was because corporations had too much excess capacity, (which means they see insufficient demand for their products and services).

And so government has had to step in to counteract the cash hoarding of some $1.8 trillion being held by the S&P 500 corporations alone, to help stimulate that demand. But why such a fear of debt, when the Great Depression has provided us with a lesson of what needs to be done to counteract such fears?

Nobel economist Paul Krugman has pulled up some of the Great Depression’s history, which shows that the Hoover Administration’s emphasis on reducing deficit spending increased debt as a percentage of GDP, while shrinking actual GDP growth (and revenues). But increased government spending (and debt) during Roosevelt’s New Deal increased economic growth; so though debt loads were high, it brought the U.S. out of the 1929-1933 depression and produced 3 years of growth. The double-dip only returned in 1937, when Roosevelt listened to the bankers and tried to reduce the deficit prematurely.

“The experience of the 30s,” writes Krugman, “offers no support to those who worry about the debt consequences of deficit spending in a depressed economy — FDR didn’t do enough stimulus, but the spending he did do was not reflected in a spiraling, or even rising, debt burden. And the evidence is consistent with the view that austerity, Hoover-style, may well be self-defeating even in a narrow fiscal sense.”

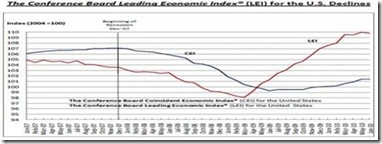

Supporting the present picture is weak growth of the Conference Board’s Index of Leading Economic Indicators, a monthly snapshot of 12 important indicators that affect future growth, such as interest rates, and hours worked.

"The LEI decreased in two of the last three months, but its level is still about 4.5 percent above its previous peak before the recession began," said Ataman Ozyildirim, economist at the Conference Board. "Moreover, the gains among the LEI components have been widespread, with the exception of housing permits and stock prices, pointing to an expanding economy, but at a slower pace in the second half of the year."

A major reason for continued sluggish growth is that real estate has still to work off more than 1 million units in excess inventory built up over the bubble years. Total units of housing inventory peaked in 2006, but months of supply didn’t peak until 2008, as the sales’ rate declined drastically during the credit crisis and failure of lending institutions such as Lehman Brothers and Bear Stearns.

This increase in inventory is especially bad news because the reported 8.9 months of supply in June is well above normal.

So there is good reason for the Fed to continue to hold interest rates at record lows, and Chairman Bernanke has continued his promise to do so for “an extended period” in his testimony. "We are ready and we will act if the economy does not continue to improve -- if we don't see the kind of improvements in the labor market that we are hoping for and expecting," he said.

Harlan Green © 2010

No comments:

Post a Comment