"We're seeing a strong divergence between animal spirits of the stock market and what we're actually seeing unfold from businesses and business leaders," a White House official told reporters Monday, CNBC reported, adding, "The latter is obviously more meaningful than the former on what's in store for the economy in the medium to long term."

The White House admission that the rise in “animal spirits” over Trump’s reelection had waned and that business leaders with were guiding the financial markets lower “in the medium to long term” because of Trump’s on again, off again tariff announcements, thereby doubting the possibility that the Republican campaign promises of lower taxes and fewer regulations will be of much benefit.

Such market enthusiasm couldn’t last when it became obvious that Trump’s contradictory messaging and his lack of knowledge about foreign trade could lead to tariff wars, which in the words of a growing number of business leaders, showed “he doesn't know what he is doing”.

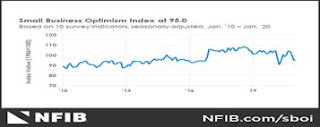

Consumers are beginning to catch on as well, which is resulting in the decline of their own animal spirits. The above chart of declining consumer confidence as measured by the University of Michigan last peaked in January 2024 with Donald Trump’s re-election, when consumers believed in Trump’s promises to bring down inflation on “Day 1” of his second term.

But that hasn’t yet happened, and consumers are not happy about it. In the words of the U. of Michigan’s survey director Joanne Hsu:

“Consumer sentiment fell for the second straight month, dropping about 5% to reach its lowest reading since July 2024. This decrease was pervasive, with Republicans, Independents, and Democrats all posting sentiment declines from January, along with consumers across age and wealth groups.”

The term, “Animal Spirits”, was first coined during the Great Depression to explain why consumer behaved the way they did. Roosevelt’s New Deal that gave workers more benefits, such as the 8-hour work day, workers compensation, and social security, was created to boost their spirits and led to the recovery from the Great Depression.

Nobel Laureates George Akerlof and Robert Shiller even wrote a book about it that was entitled, Animal Spirits; How Human Psychology Drives the Economy and Why It Matters for Global Capitalism.

It was an important book because it refuted the long-held theory that so-called free market, or Laissez Faire, economic theories create more sustained growth with fewer regulations.

But Republicans’ touting of the benefits of sless regulated markets was a giant lie that led to President Reagan’s trickle-down economic theories, because with little or no oversight or regulations of their trades, the wealthiest always prospered the most because they had the time and money to research the markets.

Therefore conservatives that favored less regulation had to create a myth that some of that wealth was bound to “trickle down” to Main Street and benefit ordinary wage-earners to placate voters.

Professors Akerlof and Shiller showed it was a lie. Most consumers in fact do not have the resources or knowledge to adequately research what they buy or invest in. They discovered in their research that most consumers act on hearsay, or word of mouth, in making purchase decisions, including when to buy real estate.

And because consumers didn’t or wouldn’t do the necessary historical research in early 2000 when buying homes, but believed that housing prices could never decline, they pushed up housing prices so much that builders built too many homes, which was a major reason for the busted housing bubble and resultant Great Recession.

History has shown that the tax cuts and market regulations the Trump campaign promised will make the wealthy even wealthier, and 80 percent of Americans that are wage earners, less wealthy.

It’s the real reason Trump has unleashed “Chainsaw Musk”—to terrorize government workers into quitting their jobs and destroy as much as possible of Roosevelt’s New Deal, and the laws and regulations that have benefited most Americans since then.

Harlan Green © 2025

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen