The Mortgage Corner

Mortgage delinquencies are declining—the kind that tell us we may be seeing an end to falling real estate prices. That is, there are fewer 30-day late payments, which are the first indicator of trouble leading to short sales and foreclosures. Most 30-day lates do get cured, as it may have been a payment oversight. Payments are usually 60-90 days late before the lender takes notice and may file a Notice of Default; signaling that the 90-day period has started before said lender publishes its Notice of a Foreclosure proceeding.

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 8.22 percent of all loans outstanding as of the end of the fourth quarter of 2010, a decrease of 91 basis points (almost 1 percent) from the third quarter of 2010, and a decrease of 125 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

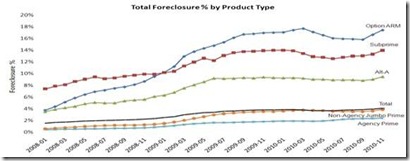

We are really talking about all the liar loans done from 2005 to 2007—the teaser rate Option ARMs, Subprime and Alternative documentation (Alt-A) loans that didn’t require income and maybe asset verification. The so-called Agency Prime (Fannie Mae and Freddie Mac) delinquency rate has always been less than 1 percent, as their qualification requirements have been the gold standard for underwriting mortgages. Not only do income and assets get verified, but also the likelihood of continued employment.

Jay Brinkmann, MBA's chief economist said "These latest delinquency numbers represent significant, across the board decreases in mortgage delinquency rates in the US. Total delinquencies, which exclude loans in the process of foreclosure, are now at their lowest level since the end of 2008. Mortgages only one payment past due are now at the lowest level since the end of 2007, the very beginning of the recession. Perhaps most importantly, loans three payments (90 days) or more past due have fallen from an all-time high delinquency rate of 5.02 percent at the end of the first quarter of 2010 to 3.63 percent at the end of the fourth quarter of 2010, a drop of 139 basis points or almost 28% over the course of the year. Every state but two saw a drop in the 90-plus day delinquency rate and the two increases were negligible."

Unfortunately, Reo, bank-owned properties are still making up 30 percent of home sales. But banks seem to be cooperating more with homeowners in trouble, as the short sales’ percentage of total sales has risen to 5 percent (i.e., those sales where existing lender agrees to cut mortgage principal to make the sale), which has brought down the percentage of foreclosure sales.

"While delinquency and foreclosure rates are still well above historical norms,” said Brinkman, “we have clearly turned the corner. Despite continued high levels of unemployment, the economy did add over 1.2 million private sector jobs during 2010 and, after remaining stubbornly high during the first half of 2010, first time claims for unemployment insurance fell during the second half of the year. Absent a significant economic reversal, the delinquency picture should continue to improve during 2011.”

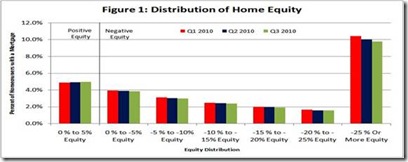

An interesting graph put out by Calculated Risk shows that up to 24 percent of all homeowners with mortgages are underwater, with 10 percent having mortgages which are more than 125 percent of their home’s value. It is this number that has to continue to decline, before the foreclosure rate declines substantially.

We know that it is ultimately the amount of available housing that determines whether housing prices will improve. And the huge number of distressed sales has added to the supply. Though prices have risen from their ‘double-dip’ lows in early 2010, there has to be a substantial drop in that supply—read drop in both foreclosures and short sales—for prices to begin a longer term rise.

So it may take the rest of this year for housing inventory to drop sufficiently to stop the decline in housing prices. Why? It takes a better jobs market to bring down the foreclosure rate, and so housing supply. This is turn boosts housing prices.

Harlan Green © 2011

2 comments:

Yes, the column, "Mortgage Delinquencies are Falling" may be used with proper citation. Editor, Popular Economics Weekly

http://www.cafb29b24.org/docs/buyativan/#36489 lorazepam 1 mg for sleep - can you overdose ativan

Post a Comment