There is a tremendous misunderstanding of how to boost economic growth, and this is hurting the recovery. Conservative politicians want to cut taxes and government services, while progressives want to use government to boost growth. Yet it really doesn’t matter who does the boosting. The results are the same.

The best way to understand growth is with a concept used by economists, aggregate demand, that we have mentioned in past columns. Aggregate demand can be thought of as income and assets earned by consumers, private business, the financial sector and government. And said income and assets can be either hoarded in mostly MZM accounts (Money at Zero Maturity—i.e., earning 0 interest), as it is now, spent on things, or invested in facilities that produce more things.

Our economy has become seriously skewed during the past 10 years because corporate profits zoomed, while household incomes have not even kept up with inflation.

This is not the column to discuss the whys, including why so much income has migrated to the top 1 percent income bracket. But the result has been that most corporations haven’t invested in their employees. Which is why aggregate demand—the source of economic growth—has suffered mightily.

We know that consumers make up 70 percent of GDP growth, for example. So because their incomes were stagnant, they had to borrow to maintain their standard of living. And because they indebted themselves so heavily while their incomes remained stagnant, most have not been able to boost their spending during the recovery.

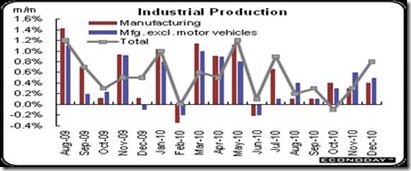

So business spending, which makes up the other part of aggregate demand (along with government spending) hasn’t been expanding because of so much excess industrial capacity. We know that excess capacity is still a problem today, as evidenced by the latest industrial production numbers.

Overall capacity utilization is improving, rising to 76.0 percent in December from 75.0 percent in November. It is at its highest since a reading of 77.9 percent for August 2008, but is still far below the 82 percent long term average.

Industrial production posted a healthy 0.8 percent gain in December, following a 0.3 percent rebound in November. However, the boost was led by a monthly 4.3 percent surge in utilities output, following a 1.5 percent increase in November. By market groups, strength was widespread. Production of consumer goods increased 1.0 percent in December; business equipment, 0.6 percent; nonindustrial supplies, 0.1 percent; and materials, 1.0 percent.

And because most profits have not been flowing back to average consumers, employers are not seeing enough demand for their products and services to warrant hiring more workers. That is the major reason for the entire government stimulus—to boost aggregate demand. The $787 Billion American Recovery and Reinvestment Act (ARRA) was in fact not enough to bridge the so-called lost output gap between potential and actual GDP growth over the past 2 years. The Fed’s purchase of government securities has held down interest rates, enabling businesses to borrow cheaply, and preventing real estate values from going into free fall.

Then what is the answer on how to create sustainable aggregate demand? The major push should be reestablishing the middle class that has been so decimated by lost jobs and much of its wealth—both in stocks and real estate. New York Times’ David Leonhardt is one of the few pundits to voice this concern in his most recent column, “In Wreckage of Lost jobs, Lost power,” in which he laments the loss of labor’s bargaining power.

Whereas employment in most other developed countries, including Japan and Russia, is much higher than in the U.S., corporate profits are lower. This is because U.S. domestic workers’ bargaining power has been severely diminished, in part because of laws that give employers the advantage in hiring and firing. And Germany and Canada, who barely had a recession, encourage companies to cut work hours for all during slowdowns—called ‘short work’—rather than lay off some, so that the pain of reduced incomes is spread over the entire workforce.

There are many other ways to cure insufficient aggregate demand, such as more progressive taxation. For instance, the top income tier during the Eisenhower years had a 95 percent tax rate on its top income bracket. This had the effect of siphoning off money from the wealthiest who spend the least percentage of their income, and putting it into the more productive use of building infrastructure, such as the interstate highway system, or education, or into more research and development.

Also, a better-run health care system would reduce health costs, which are double per capita in the U.S. vs. other developed countries. This would have several benefits, including increasing the competitiveness of U.S. made products, while boosting workers’ benefits and incomes.

There is still almost $3 trillion in lost output—the difference between actual and potential GDP growth caused by the recession, as we said. But unless we get over the conservative-progressive divide on how to bridge that gap, we won’t be able to generate sufficient aggregate demand that will bring back the jobs and salaries lost during the worst downturn since the Great Depression. U.S. workers don’t care which sector generates their jobs, so neither should politicians.

Harlan Green © 2011

No comments:

Post a Comment