Popular Economics Weekly

It is now beyond a reasonable doubt that Germany and its austerity cohorts want to drive Greece out of the Eurozone by insisting that it adhere to its agreement to pass most of its meager budget surplus to service its foreign debt, rather than invest it back into the Greek economy. It is insisting that Greece cut government spending enough so that it carries what is called a huge ‘primary’ budget surplus of 4.5 percent (a surplus before its bills are paid—ie, largely interest to its creditors).

The EU, led by Germany, had crafted several agreements that gave Greece large loans to service that debt, while forcing it to submit to severe austerity and wage cuts.

“The results have been catastrophic, said the Guardian in a 2013 article: “cumulative economic contraction approaching 25 percent, adult unemployment at nearly 30 percent, youth unemployment close to 65 percent, unprecedented poverty, destruction of the welfare state and humanitarian crisis in the urban centres. Greek debt, meanwhile, is currently higher than in 2010, standing at €321bn and, since the economy has collapsed, its ratio to GDP approaches an exorbitant 180 percent. This is the background to the current debate.”

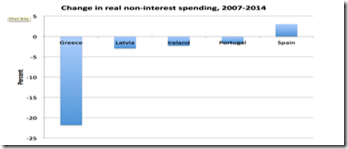

But to do so would in effect drive Greece even further into its depression, since it means lower tax revenues, which means even more debt. The consequence is the layoff of more workers and further reduction of average household incomes. Paul Krugman put up a graph of the cutbacks in spending that in turn have made Greece’s debt burden worse, compared to other countries that agreed to the EU’s austerity terms.

Greece has already paid the piper, in other words, while Germany now has the largest budget surplus of all western countries. “Greece has done a lot more austerity than those countries cited as supposed success stories,” says Krugman, “(which is another issue — success being defined as “not total collapse, and slight recovery after years of horror” — but that’s a different story).”

So Greece has little choice but to exit the euro currency, unless some last minute compromise with the EU is possible. Its unemployment rate is currently 25.8 percent, the worst in the Eurozone (slightly more than Spain’s 23.7 percent), as it has been in a deflationary spiral, further depressing its economic activity.

Graph: Trading Economics

Although Greece mostly lived up to the terms of the bailout, the promised growth never materialized. As Greek Prime Minister recently said: "We are not negotiating the bailout; it was cancelled by its own failure.” Calculated Risk tabulated the difference between the forecasted results of its austerity cutbacks and the actual result.

Greece: Annual GDP, Forecast and Actual

Year Promised Actual

· 2009 -2.0 -4.4

· 2010 -4.0 -5.4

· 2011 -2.6 -8.9

· 2012 +1.1 -6.6

· 2013 +2.1 -3.9

The only choices are to allow Greece to run a smaller primary surplus (currently 1.5 percent), leaving more of its revenues to benefit its own citizens, or for Greece to leave the Eurozone and default on all their debt. What will it be?

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment