The Federal Reserve’s Open Market Committee announced it is raising

short term interest rates by ¼ percent. But can this economy continue to

grow with higher interest rates, as Fed Chairwoman Yellen has promised?

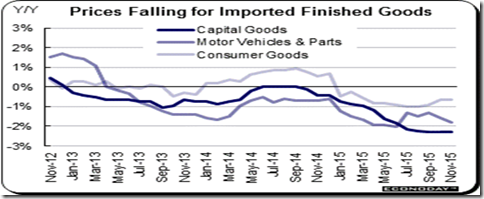

That depends on several mundane factors, such as cheap gas and energy prices that have been helping to hold down consumer and producer costs. And since most consumer and many producer products are imported, the more expensive dollar exchange rate has made them cheaper. Hence the very low inflation rate these days.

An early sign of continued growth is the Conference Board’s Index of Leading Economic Indicators (LEI). The 12 leading indicators it tracks predict “moderate” future growth. And Congress’s new era of cooperation has resulted in the passing of two very important spending bills—the $305 billion Surface Transportation bill, and $1.14 Trillion federal budget.

Boosted by yesterday’s strong showing for housing permits (housing will be another area of strong growth next year), the LEI rose a solid 0.4 percent in November on top of October’s very strong 0.6 percent rise. Other positives include the interest-rate spread, specifically low short-term rates, and also gains for the stock market.

The legislation pairs two enormous bills: a $1.14 trillion government-wide spending measure to fund every Cabinet agency through next September, and a $680 billion tax package extending dozens of breaks touching all sectors of the economy, making several of them permanent and tossing the entire cost onto the deficit.

President Barack Obama is expected to sign the legislation today. The bill cleared both chambers easily, first in the House, which passed it 316-113, followed by the Senate in a 65-33 vote.

The biggest reason this benefits economic growth is that another spending sequester was avoided, a sequester that limited spending across the board, hurting all segments of the economy. There was not even a spending cap, which means governments can function again without the interference of the Austerians, those conservatives that have been trying to restrict government spending on everything, including research and development. The $1.14 trillion spending bill avoids a shutdown next week, when the government’s current funding was scheduled to expire at 12:01 a.m. on Dec. 23.

Refunding the Highway Trust Fund that has run out of funds will be the biggest beneficiary of the $305 billion surface transportation bill. Called Fixing America’s Surface Transportation Act, or the FAST Act, it fixes and replaces badly degraded railroads, highways and bridges, hence it benefits those industries that depend on surface transportation.

One big benefit of the bill is the creation of programs to focus federal aid on eliminating bottlenecks and increasing the capacity of highways designated as major freight corridors. The Transportation Department estimates the volume of freight traffic will increase 45 percent over the next 30 years, which gives a tremendous boost to productivity.

The five-year FAST infrastructure bill is the longest reauthorization of federal transportation programs that Congress has approved in more than a decade, ending an era of stopgap bills and half-measures that left the Highway Trust Fund nearly broke and frustrated local governments and business groups. President Obama will sign the bill into law, as it fulfills his long-running push for lawmakers to pass an infrastructure bill even though it is significantly less than the $478 billion he sought in his own plan earlier this year.

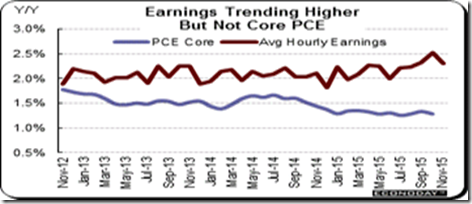

Lastly, and perhaps the best reason interest rates won’t have much effect on future growth—at least through next year—is hourly earnings are finally rising above the very low inflation rate, which means we are reaching full employment. That’s why consumers have become more upbeat, hence are spending more. Average hourly earnings in the last unemployment report rose 2.3 percent annually, whereas the core PCE inflation index favored by the Fed has risen just 1.3 percent.

In fact, that is a major reason the Fed raised short term rates at this time, in the teeth of holiday spending. Wages and salaries are finally showing signs of life—of rising faster than inflation. Fed Chair Yellen has said many times it is a precondition for raising short term rates, which mainly influence consumer spending via credit card and auto loan rates.

So as long as inflation stays low and wages continue to increase the U.S. economy will continue to grow. And with Iran about to join the oil markets, energy prices should remain at the low end, with some analysts predicting oil prices could drop as low as $20 per barrel next year. So what’s to worry about? The Fed really can now sit on the sidelines, until and if inflation again catches up with wage and salary growth.

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

That depends on several mundane factors, such as cheap gas and energy prices that have been helping to hold down consumer and producer costs. And since most consumer and many producer products are imported, the more expensive dollar exchange rate has made them cheaper. Hence the very low inflation rate these days.

An early sign of continued growth is the Conference Board’s Index of Leading Economic Indicators (LEI). The 12 leading indicators it tracks predict “moderate” future growth. And Congress’s new era of cooperation has resulted in the passing of two very important spending bills—the $305 billion Surface Transportation bill, and $1.14 Trillion federal budget.

Boosted by yesterday’s strong showing for housing permits (housing will be another area of strong growth next year), the LEI rose a solid 0.4 percent in November on top of October’s very strong 0.6 percent rise. Other positives include the interest-rate spread, specifically low short-term rates, and also gains for the stock market.

“The U.S. LEI registered another increase in November, with building permits, the interest rate spread, and stock prices driving the improvement,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “Although the six-month growth rate of the LEI has moderated, the economic outlook for the final quarter of the year and into the new year remains positive.”Congress on Friday passed far-reaching legislation funding the government through next September plus passing tax breaks for business and low-income families. It was a compromise that helped the GOP, also, as the bill lifts a 40-year-old ban on oil exports.

The legislation pairs two enormous bills: a $1.14 trillion government-wide spending measure to fund every Cabinet agency through next September, and a $680 billion tax package extending dozens of breaks touching all sectors of the economy, making several of them permanent and tossing the entire cost onto the deficit.

President Barack Obama is expected to sign the legislation today. The bill cleared both chambers easily, first in the House, which passed it 316-113, followed by the Senate in a 65-33 vote.

The biggest reason this benefits economic growth is that another spending sequester was avoided, a sequester that limited spending across the board, hurting all segments of the economy. There was not even a spending cap, which means governments can function again without the interference of the Austerians, those conservatives that have been trying to restrict government spending on everything, including research and development. The $1.14 trillion spending bill avoids a shutdown next week, when the government’s current funding was scheduled to expire at 12:01 a.m. on Dec. 23.

Refunding the Highway Trust Fund that has run out of funds will be the biggest beneficiary of the $305 billion surface transportation bill. Called Fixing America’s Surface Transportation Act, or the FAST Act, it fixes and replaces badly degraded railroads, highways and bridges, hence it benefits those industries that depend on surface transportation.

One big benefit of the bill is the creation of programs to focus federal aid on eliminating bottlenecks and increasing the capacity of highways designated as major freight corridors. The Transportation Department estimates the volume of freight traffic will increase 45 percent over the next 30 years, which gives a tremendous boost to productivity.

The five-year FAST infrastructure bill is the longest reauthorization of federal transportation programs that Congress has approved in more than a decade, ending an era of stopgap bills and half-measures that left the Highway Trust Fund nearly broke and frustrated local governments and business groups. President Obama will sign the bill into law, as it fulfills his long-running push for lawmakers to pass an infrastructure bill even though it is significantly less than the $478 billion he sought in his own plan earlier this year.

Lastly, and perhaps the best reason interest rates won’t have much effect on future growth—at least through next year—is hourly earnings are finally rising above the very low inflation rate, which means we are reaching full employment. That’s why consumers have become more upbeat, hence are spending more. Average hourly earnings in the last unemployment report rose 2.3 percent annually, whereas the core PCE inflation index favored by the Fed has risen just 1.3 percent.

In fact, that is a major reason the Fed raised short term rates at this time, in the teeth of holiday spending. Wages and salaries are finally showing signs of life—of rising faster than inflation. Fed Chair Yellen has said many times it is a precondition for raising short term rates, which mainly influence consumer spending via credit card and auto loan rates.

So as long as inflation stays low and wages continue to increase the U.S. economy will continue to grow. And with Iran about to join the oil markets, energy prices should remain at the low end, with some analysts predicting oil prices could drop as low as $20 per barrel next year. So what’s to worry about? The Fed really can now sit on the sidelines, until and if inflation again catches up with wage and salary growth.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment