Financial FAQs

There is still much we can be thankful for this Thanksgiving, in spite of tax raises and government spending cuts that affect mostly the poorest—whether it’s less food stamps, early child care, environmental protection, and maybe even fewer funds to fully implement the Affordable Care Act.

We finally have almost-universal health care, 92.7 percent of our workforce is employed, and we are better off than the Europeans. Europe is still in recession after 4 years of austerity policies that have resulted in sky-high unemployment rates, rather than benefiting from the quantitative easing policies that our Federal Reserve has initiated since September 2012 that has kept even long term interest rates at record lows.

So we can be thankful that Ben Bernanke is the current Fed Chairman. And in January pro-labor economist Janet Yellen will be the new Federal Reserve Chairman. I believe we can therefore look forward to continued low interest rates leading to greater job creation for some years to come.

We mustn’t listen to those Austerians that keep crying stocks and even real estate might be re-inflating asset bubbles, as happened with the recent housing bubble. Household income isn’t growing enough, and consumer debt is still too high to re-ignite any bubbles, though it is returning to more sustainable levels.

Consumer debts have declined to the lowest level in 30 years, according to the Federal Reserve’s just released Q2 2013 Household Debt Service and Financial Obligations Ratios report. This will boost consumer spending, and housing values. The enclosed graph dating back to 1980 shows that the overall Household Debt Service ratio (red line) is actually lower than it was in 1980, while the Homeowner Mortgage (blue line) and Consumer (yellow line) ratios are back to 1980 levels.

We can also be thankful that the housing market is in recovery, with prices up some 13.3 percent just this year, according the Case-Shiller Index, reducing mortgage default and foreclosure rates. That is largely because of the Fed’s low interest rates that are helping consumers to pay down their debts.

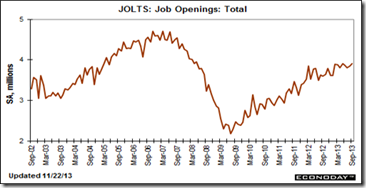

A good report that few see is the Bureau of Labor Statistics’ JOLTS report of job openings, layoffs and transfers. Job openings are basically back to 2005 levels. But because many more millions have joined the labor force since then, it hasn’t yet brought us closer to full employment.

There were 3.913 million job openings in September, up from 3.844 million in August. The number of job openings decreased in arts, entertainment, and recreation and was little changed in all remaining industries and in all four regions. But it reflects the 204,000 payroll jobs created in October, which shows job creation increasing faster than previously.

The number of hires in September was 4.585 million, essentially unchanged from 4.559 million in August. The number of hires was little changed for total private and government, as well as for all industries and all four regions. There were 4.426 million total separations in September, little changed from 4.405 million in August.

So there is more to be done to boost economic growth. But I see the cup as half full, and the economic odds are it will continue to fill.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

No comments:

Post a Comment