Popular Economics Weekly

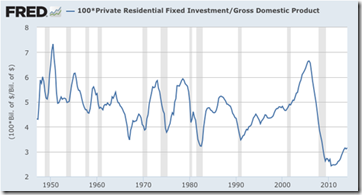

Dean Baker, a noted economist with the Center for Economic Policy and Research (NEPR), has probably given the best and most understandable reason for the Great Recession and ultra-slow recovery—it’s the lousy housing market. The economy is growing at slightly over 2 percent, when we would expect 3 percent growth 5 years after the end of the Great Recession.

“The basic story of the Great Recession is about as simple as they come,” says Baker. “The economy was being driven by a housing bubble and the bubble burst. The combination of the loss of housing construction, due to the enormous overbuilding of the bubble years, and the loss of the consumption that had been driven by bubble generated housing wealth, created a gap in annual demand of more than $1 trillion. That's all simple and easy.”

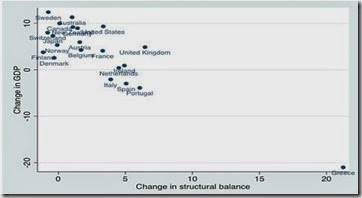

So the weak housing market, even with the Fed doing all it can do to keep interest rates at rock bottom, hasn’t boosted US growth sufficiently to approach full employment. Why? The housing market would be recovering sooner if government was allowed to do more, because of austerity policies prevalent both here and in Europe. And the results are easy to see in this Paul Krugman graph.

Those countries with the lowest growth rates have the most stringent austerity measures—i.e., most drastic budget cuts and highest interest rates when government should be keeping interest rates as low as possible. And they are the United Kingdom, Spain, Portugal and Greece, of course. But the US isn’t far behind, in line with France that is having its own budget problems.

What should be done? We know the government has to help, either with mortgage relief (buy up the bad mortgages and hold them until the market improves), or buying the underwater housing as was done during the Great Depression, and selling them back when conditions improved.

The Home Owners’ Loan Corporation was set up in 1933 under the New Deal. It made more than one million loans to homeowners, sometimes bought the underwater homes, and otherwise supported homeowners who were behind on their payments. Sound familiar?

The HARP and HAMP loan programs were current attempts to do the same and they have refinanced 3 million of the 16 million homes guaranteed by Fannie Mae and Freddie, according to The Housing Wire and FHFA, the Federal Housing Finance Authority that supervises Fannie and Freddie.

“…what did economists think would fill a trillion dollar gap in annual spending?” laments Baker. “Of course the government could do it with more spending and/or tax cuts, but since we have a religious cult in Washington that says it is better to keep millions out of work than to run deficits, this was a political impossibility.”

So 8 million more homes are eligible, according to the FHFA, and the White House has done little to promote HARP 3.0, a newer version that would loosen qualification standards to increase eligibility for those behind on their payments, which would allow more homes to be refinanced. It doesn’t look like another New Deal for housing is in the offing.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment