I said last month June’s labor market was hot. It was even hotter in July. Every industry in the Labor Department’s unemployment report had positive job growth in July, with Education and Health alone adding 122,000 jobs. Professional/Business, Leisure and Hospitality, and Government added another 242,000 jobs.

How is this possible with all the talk of a looming recession? Maybe the minus-1.25 percent negative cumulative GDP growth in Q1 and Q2 was just a blip that may or may not have been a technical recession, and it’s already over?

Hiring was broad based as businesses created the most jobs in five months, said MarketWatch. And the number of people working finally returned to February 2020 levels — the last month before the pandemic (my emphasis). The unemployment rate, meanwhile, slipped to 3.5 percent from 3.6 percent, the government said Friday, matching the lowest level since the late 1960s.

Let us now see how much higher the Federal Reserve dares to push interest rates because of fears such robust hiring is a sign of surging growth, not the slowdown in demand it is attempting to engineer.

In fact, inflation is already declining, mainly because world oil prices have plunged, and food prices may also soften with the good news that grain shipments from the Ukraine have finally begun.

That’s in part because U.S. consumers' expectations for where inflation will be in a year and three years dropped sharply in July, a New York Federal Reserve survey showed on Monday, as reported by Reuters, indicating U.S. central bankers might be winning the fight to keep the outlook for price growth as they battle to tame high inflation—although official CPI inflation numbers out later this week will confirm or deny whether said expectations are reliable.

“Median expectations for where inflation will be in one year tumbled 0.6 percentage point to 6.2 percent and the three-year outlook fell 0.4 percentage point to 3.2 percent, the lowest levels since February of this year and April of last year, respectively,” said Reuters.

For the one-year outlook, the fall in expectations was driven by big drops in year-ahead price growth changes for gasoline and food, with the decline in anticipated gasoline price growth being the second largest in the survey's nine-year history and the decline in food price growth the largest ever.

In fact, the current hiring surge may lower inflation. The inflation surge is mainly caused by supply shortages, and more jobs means more workers producing goods and services which increases the supply of things.

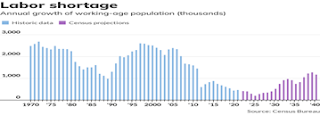

But MarketWatch economist Rex Nutting is warning of one obstacle to continued jobs growth, a looming shortage of working-age adults, I said last week. The baby boomer population bulge of the 1970s has reached retirement age, and the millennials cohort of the 1990s, their offspring, will be approaching retirement age as well, as is seen in his graph of population growth rates.

“But now the tide is going out. Next year, the working-age population is expected to grow by just 400,000. In 2024, it’s expected to grow by 300,000 and by just 200,000 in 2025. The pool of workers will begin to grow a bit faster later in the decade and throughout the 2030s, but current projections through 2060 don’t foresee the labor supply returning to the same growth rate we’ve gotten used to over the past 70 years.”

And that means slowing economic growth as well, unless we allow more working-age adults to immigrate and invest in more productive technologies, since more workers producing more goods and services powers economic growth.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment