The Labor Department’s JOLTS report just out shows job openings are still at twice the number of jobs hirings. How does this justify what seems to be pundits fixation on the possibility of a recurring 1970’s wage-price spiral causing prolonged inflation? It’s one reason Fed Chair Powell has been saying we will feel more pain before the inflation surge is tamed.

The current inflation spike is nothing like what happened in the 1970’s era of stagflation with the Arab oil embargo raising energy prices, and trade unions able to match that inflation with rising wages. Hence the so-called wage-price spiral that created slow growth with high unemployment at the time.

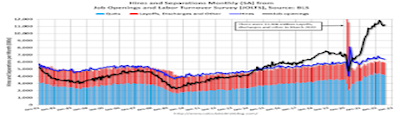

Today in the face of such high inflation the number of job openings in the government’s JOLTS report continues far in excess of job hirings, according to the Bureau of Labor Statistics (BLS) and the unemployment rate has remained at 3.5 percent, a record low. Openings have even risen back to its high from last month’s slight drop to 10.9 million openings. This is while the Fed keeps promising to raise short-term rates until it hurts!

It's the highest inflation rates in 40 years that the Fed is attempting to conquer. Former Fed Chair Ben Bernanke explained how the current inflation period differed from the 1970s recently in a recent NY Times article, when he said six months of higher inflation today doesn’t equal its 14 month span during the “Great Inflation” of the 1970s.

“In short, the lessons learned from America’s Great Inflation, by both the Fed and political leaders, make a repeat of that experience highly unlikely. The Fed today recognizes that it must take the leading role in controlling inflation, and it has the tools and sufficient political independence to do so. After a delay caused by a misdiagnosis of the economy in 2021, the Fed has accordingly turned to tightening monetary policy, ending its pandemic-era bond purchases, announcing plans to shrink its securities holdings and raising short-term interest rates.”

The number of job openings was little changed at 11.2 million on the last business day of July, the U.S. Bureau of Labor Statistics reported. Hires and total separations were little changed at 6.4 million and 5.9 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.4 million) were little changed.

The hires are blue line and job openings the black line in the above Calculated Risk graph of the JOLTS report. That’s 5.3 million more job vacancies that businesses say they want to fill.

Corporations are so flush with the highest profits ever more than 40 years, as high as in the 1950s post-WWII as a percentage of GDP, that they don’t seem to care their cost of borrowing is rising. But won’t consumers care and cut back on their spending? Probably, which means growth will continue to slow of its own accord, since consumer spending makes up some 70 percent in GDP growth.

Yet, a measure of how consumers feel about the economy right now rose to 145.4 in August from a 15-month low of 139.7 in the prior month, the nonprofit Conference Board said Tuesday.

The Index now stands at 103.2 (1985=100), up from 95.3 in July. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—improved to 145.4 from 139.7 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—increased to 75.1 from 65.6.

“Consumer confidence increased in August after falling for three straight months,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index recorded a gain for the first time since March. The Expectations Index likewise improved from July’s 9-year low, but remains below a reading of 80, suggesting recession risks continue. Concerns about inflation continued their retreat but remained elevated.”

“Meanwhile, purchasing intentions increased after a July pullback, and vacation intentions reached an 8-month high. Looking ahead, August’s improvement in confidence may help support, but inflation and additional rate hikes still pose risks to economic growth in the short term,” continued Franco.

We hope that Fed Chair Jerome Powell doesn’t believe the Paul Volcker era has returned, when Volcker raised interest rates to 20 percent to tame the prolonged inflation from the 1970s and caused two recessions before he tamed it.

We are not even in any sustained inflationary wage-price spiral, since wages have fallen slightly as a percentage of GDP ((-1.5 percent, according to MarketWatch’s Rex Nutting) who I quoted last week, whereas corporate profits have soared to post-WWII highs.

That’s why we hope Chairman Powell isn’t looking in the rear-view mirror of past history instead of his windshield to see what’s looming ahead, which is a period of naturally sinking inflation and improved supply-chains with consumers already feeling more optimistic about their future and continued corporate profits that will keep creating new jobs.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment