I was a bit facetious last week when I said calling a recession at this time because we may have two consecutive quarters of negative GDP growth is almost irrelevant, because it may be over as quickly as the artificially induced two-month recession in April-May 2020, when the pandemic was building a head of steam.

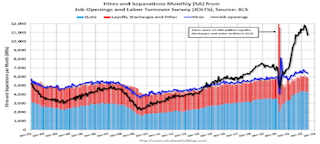

But another indicator, the JOLTS report that measures the number of job openings (black line in graph) decreased to 10.7 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. The slight decline in openings was too small to be conclusive of an extended downturn

Hires and total separations were little changed at 6.4 million and 5.9 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.3 million) were little changed.

The number of job opening didn’t rise above the longer term normal of 6-7 million openings until January 2017, per the Calculated Risk graph. That is when economic growth began to take off, and it rose sharply to its current nosebleed range of 11 million openings after the two-month 2020 recession.

The number of hires (blue line) and Layoffs (red bar) leveled off and began to taper in January 2022 per the graph, so then began a slight downturn in job formation that could predict looming negative GDP growth.

What better proxy for the beginning of a recession than the slowing of job growth? I also mentioned last week that consumer confidence was another good proxy, which is still in decline.

We will know more this Friday with release of the government’s July unemployment report. The rate has been below 4 percent since last December.

But we have now the just released ISM non-manufacturing survey of supply managers beginning to rise again. The ISM barometer of business conditions at companies such as restaurants and hotels that employ most workers rose to a three-month high of 56.7 percent in July, suggesting the economy is beginning to expand again in the face of growing headwinds.

“According to the Services PMI®, 13 industries reported growth,” reported Anthony Nieves, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee. “The composite index indicated growth for the 26th consecutive month after a two-month contraction in April and May 2020. Growth continues — at a faster rate — for the services sector, which has expanded for all but two of the last 150 months. The slight increase in services sector growth was due to an increase in business activity and new orders.”

Orders and production rose, hiring improved and intense inflationary pressures eased somewhat last month, business executives told the Institute for Supply Management.

Even U.S. factory orders rose 2 percent in June, the government said Wednesday, in a report that offered some good news .Orders for durable goods made to last at least three years climbed a revised 2 percent in June, up from an initial 1.9 percent. Most of the increase was in autos and military planes. Orders for nondurable goods such as clothing and food products also rose 2 percent. Orders for nondefense capital goods, excluding aircraft rose a revised 0.7 percent, up from the prior reading of a 0.5 percent gain. Manufacturers are growing more slowly as the economy decelerates, but they are still growing.

This means we could already have reached a ‘trough’ in growth, or the bottom of the down cycle. And that confuses things even further! Stay tuned for Friday’s unemployment report to know more.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment