The Mortgage Corner

CoreLogic, a real estate analytics firm, today released new analysis showing approximately 791,000 more residential properties returned to a state of positive equity during the third quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 42.6 million.

This is helping November home sales in the South Coast, with closed transactions holding strong and huge price increases year-over-year, reports Gary Woods for MLS.

“Year over year sales are up just slightly from 2012 with the median sales price up to about $940,000 for approximately a 19 percent rise. The average sales price is also up going from about $1.36 million in 2012 to approximately $1.43 million in 2013 for a 5 percent rise while the numbers of escrows are down with 1,203 in ’12 to 1,168 in ‘13 with the median list price on those escrows up about 15 percent to approximately $960,000.”

The CoreLogic analysis indicates that nearly 6.4 million homes, or 13 percent of all residential properties with a mortgage, were still in negative equity at the end of the third quarter of 2013. This figure is down from 7.2 million homes, or 14.7 percent of all residential properties with a mortgage, at the end of the second quarter of 2013.

This is a result of the sharp rise in housing values this year. Of the 42.6 million residential properties with positive equity, 10 million have less than 20 percent equity. Borrowers with less than 20 percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints.

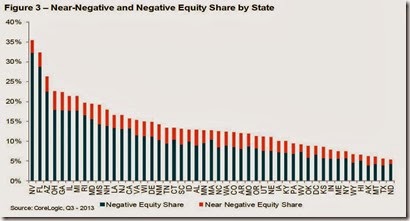

Under-equitied mortgages accounted for 20.4 percent of all residential properties with a mortgage nationwide in the third quarter of 2013, with more than 1.5 million residential properties at less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are considered at risk should home prices fall.

“Rising home prices continued to help homeowners regain their lost equity in the third quarter of 2013,” said Mark Fleming, chief economist for CoreLogic. “Fewer than 7 million homeowners are underwater, with a total mortgage debt of $1.6 trillion. Negative equity will decline even further in the coming quarters as the housing market continues to improve.”

California has the twelfth worst negative equity with 13.2 percent of those homes holding mortgages. Nevada had the highest percentage of mortgaged properties in negative equity at 32.2 percent, followed by Florida (28.8 percent), Arizona (22.5 percent), Ohio (18.0 percent) and Georgia (17.8 percent). These top five states combined accounted for 36.4 percent of negative equity in the U.S.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

No comments:

Post a Comment