Popular Economics Weekly

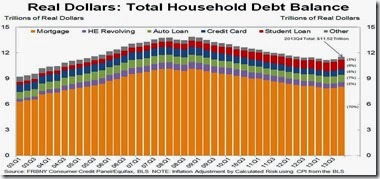

The NY Fed released their 2013 Q4 Household Debt and Credit Report. The report showed that total household debt is 9.1 percent below the Q3 2008 peak. Mortgage debt is down 13.4 percent from the peak, and Home Equity revolving debt is down 25.9 percent.

This is even though aggregate consumer debt increased by $241 billion in the fourth quarter, the largest quarter-to-quarter increase since 2007, said the NY Fed report. More importantly, between 2012:Q4 and 2013:Q4, total household debt rose $180 billion, marking the first four-quarter increase in outstanding debt since 2008.

Does this mean the household deleveraging of debt that has held down consumer spending since the Great Recession is over? Are consumers opening up their wallets finally, and will this drive increased consumer spending and so GDP growth this year?

Barron’s Gene Epstein and Applied Global Macro Research (AGMR) economists believe so. AGMR projects 4 percent in economic output this year and next, arguing that future demand for housing will also boost consumer spending by creating jobs in the many ancillary industries that service housing. This is far above the Fed’s FOMC prediction of 2.8 to 3.4 percent GDP growth through 2015. It also means unemployment has to fall below 6 percent, and the Fed will begin to raise their overnight rate to 0.25 percent from its current 0 percent.

But AGMR’s report doesn’t take into account the sharp decline in federal and local government spending, which has been a drag on growth since 2009. It would have to pick up as well, in my opinion. This is happening in states like California, whose budget is now in surplus, but not at the federal level, in spite of the $1.1 trillion budget agreement for the rest of this fiscal year.

As net household borrowing resumes, it is interesting to see who is driving these balance changes, and to compare some of today’s patterns with those of the boom period. This will help to determine how sustainable is such consumer spending, and so economic growth and job creation.

Auto and student loans have led the way and been growing for some time, while overall debt continued to fall. But in 2013, the increased credit card and mortgage debt among the young and the riskless has led to a turnaround in the trajectory of overall debt. This was the case in the comparison in debt with 2005, and is still the case today. It is the under 30-year olds that are borrowing and spending the most.

Graph: NY Federal Reserve

And we believe it is the below-30 cohort that will comprise most of the increased demand for housing, as household formation is predicted to pick up above 1 million per year for the rest of this decade, according to the 2013 Harvard Joint Center for Housing Studies’ State of the Nation’s Housing report.

“With rising home prices helping to revive household balance sheets and expanding residential construction adding to job growth, the housing sector is finally providing a much needed boost to the economy,” says Eric S. Belsky, Managing Director of the Joint Center for Housing Studies. “But long-term vacancies are at elevated levels in a number of places, millions of owners are still struggling to make their mortgage payments, and credit conditions for homebuyers remain extremely tight.”

So as always, the key will be pent-up demand for housing and consumer goods that has been constrained since 2009, due mainly to the mountain of debt that has now been reduced to more manageable levels. But government has to be included in any growth projections, and any boost in government spending is still in question.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment