It’s hard to reconcile the recent downgrade of US Treasury debt by Fitch Ratings, one of the three major debt rating agencies, to AA+ from AAA, with the US economy still at full employment.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” it said. “Several economic shocks” as well as tax cuts and new spending initiatives “have contributed to successive debt increases over the last decade,” reported MarketWatch on the downgrade.

The Bureau of Labor Statistics Job Opening and Labor Turnover Survey (JOLTS) reported an average of 5.9 million hires per month (blue line in graph), and total separations of 5.6 million, while the number of job openings has declined to 9.8 million range (black line).

That’s still a lot of job openings, mostly in government and services. Openings increased in health care and social assistance (+136,000) and in state and local government, excluding education (+62,000). Job openings decreased in transportation, warehousing, and utilities (-78,000), state and local government education (-29,000), and federal government (-21,000), said the Bureau of Labor Statistics press release.

Fitch maintained that “tighter” credit, weakening investment in business, and a “slowdown” in consumption “will push the U.S. economy into a mild recession” in the fourth quarter of this year and the first three months of next year, reported MarketWatch.

This is although most economists now see little danger of any recession at all; maybe just a ‘soft landing’ that slows economic growth once the Fed ends its interest rate hikes.

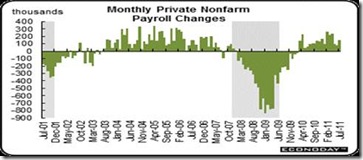

That doesn’t mean it hasn’t been a wild ride since the pandemic-induced disruptions.

The Calculated Risk graph tells the best tale of the pandemic—what our economy has endured from the effects of COVID-19. There were 13.406 million job layoffs and discharges in March 2020 (red bar spike in graph) during the nationwide shutdown when city streets emptied from the mandatory lock downs and home stays and wild animals roamed the streets.

It resulted in the shortest recession ever—just two months, April-May 2020—then economic growth suddenly reversed, and businesses hired 8 million workers (blue line) in the next couple of months.

The JOLTS report also tells us the difference between hires and total separations has averaged some 300,000 nonfarm payroll jobs, which approximates the average monthly job creations this year.

This is what Bidenomics is all about, the various aid programs and bills enacted by congress to modernize the US economy and reduce global warming. It has created something like six million jobs since President Biden took office, and maybe 3,600,000 more jobs this year.

It also tells us why the US economy continues to expand in all sectors—with consumers as well as in manufacturing. Consumers provided most of the 2.4 percent increase in Gross Domestic Product (GDP) in the ‘advance’ (first of three) estimates of second quarter economic growth.

This should confirm that no recession is imminent this year. Even if growth in Q3 and Q4 slowed, the overall year’s growth would still be positive.

Goldman Sachs chief economist, Jan Hatzius is one of the major economists who trimmed the probability of a recession in the next 12 months to 20 percent from 25 percent — well below the 54 percent median among forecasters who participated in the last Wall Street Journey survey.

“The main reason for our cut is that the recent data have reinforced our confidence that bringing inflation down to an acceptable level will not require a recession,” said Hatzius.

And as I reported earlier, Federal Reserve Chair Powell said the Fed Governors now believe we can avoid a recession at Wednesday’s post-FOMC meeting, after announcing raising the benchmark interest rate to a range of 5.25 percent to 5.5 percent, the highest level in 22 years, in order to combat “elevated” inflation.

Consumers also like the continued growth, according to the Conference Board’s July Confidence Index that jumped from 110.1 to 117.

“Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations,” said Dana Peterson, Chief Economist at The Conference Board. “Headline confidence appears to have broken out of the sideways trend that prevailed for much of the last year. Greater confidence was evident across all age groups, and among both consumers earning incomes less than $50,000 and those making more than $100,000.”

We should wait for Friday’s latest official unemployment report for the most recent unemployment picture, but it looks like Fitch Ratings is an outlier on the soundness of the US economy.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen